how much tax do you pay for uber eats

Unlike rides with Uber drivers who earn with Uber Eats are only obligated to register collect and remit sales tax from the moment they reach 30000 of revenue over the past 4 quarters. It doesnt eliminate the service fee but you pay no delivery fee and you can combine the Eats Pass with other promotions.

15 Must Know Uber Eats Tips Tricks 2022 Make More Money Driving

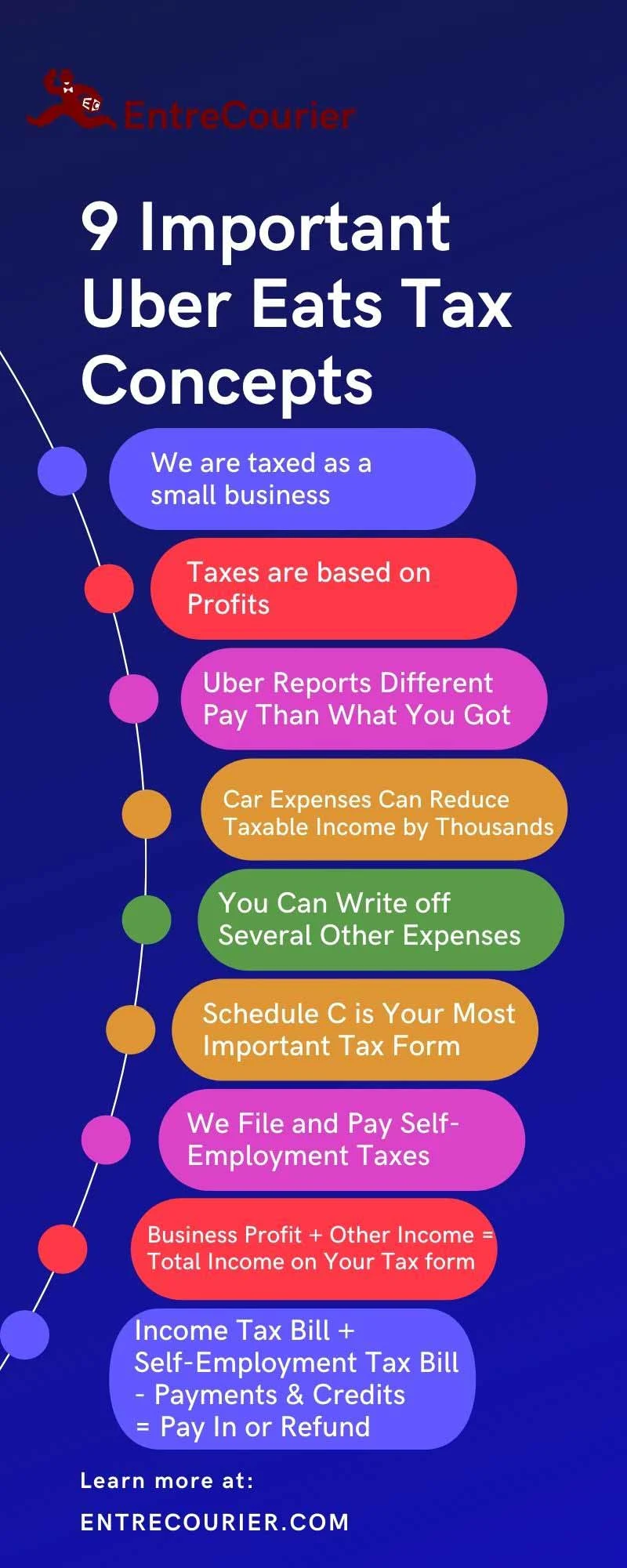

This includes 153 in self-employment taxes for Social Security and Medicare.

. You will receive two tax summaries. To use this method multiply your total business miles by the IRS Standard Mileage Rate for business. If you use Uber Eats often enough it may be worth the 999 per month to get unlimited free delivery plus 5 off.

The city and state where you drive for work. In fact one survey found that Uber Eats drivers make a median pay of 1774 per hour. According to statistics busy Australians have an obsession with food deliveryRecent research shows that Australians spend over 26 billion each year on food and drink delivery through companies such as Menulog UberEats and Deliveroo.

You are responsible to collect remit and file sales tax on all your ridesharing trips to the Canada Revenue Agency CRA. Because then you would earn much less with uber eats than eg. 3 GST for Uber Drivers 31 How GST On Uber Income Is Calculated 32 BASs For Uber Drivers.

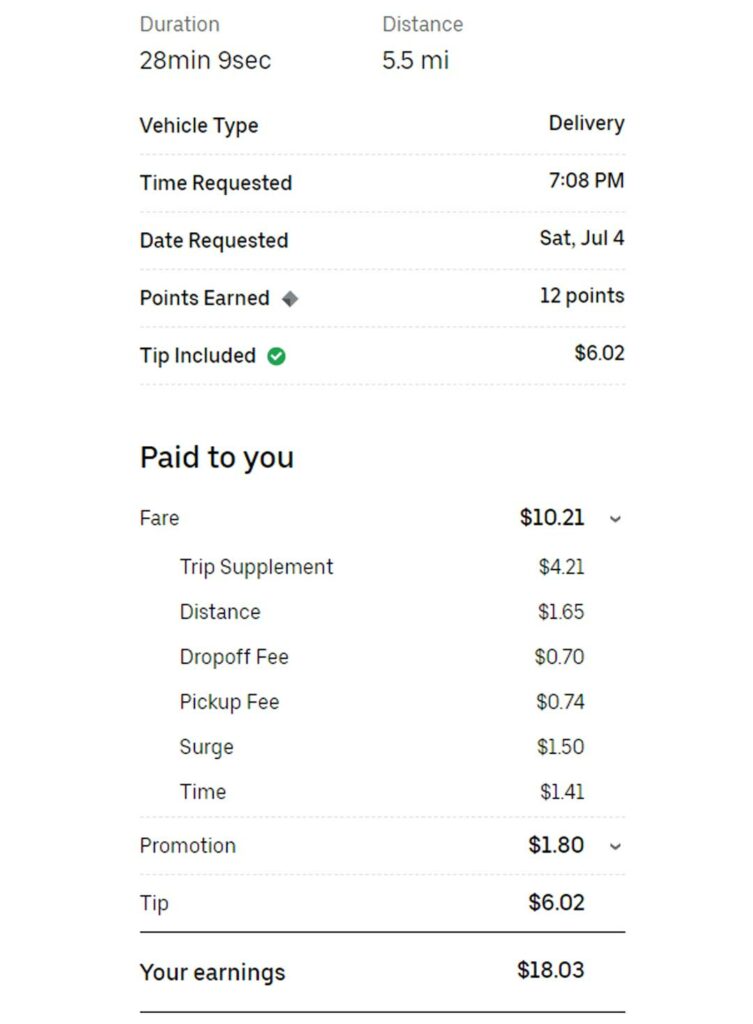

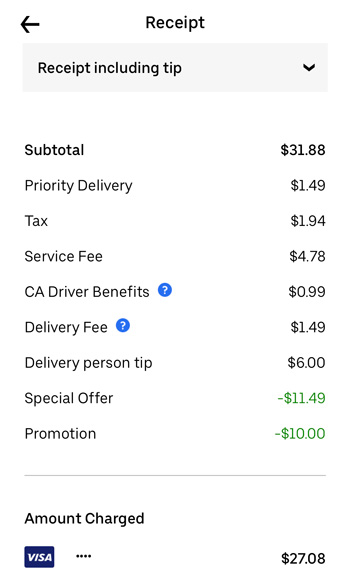

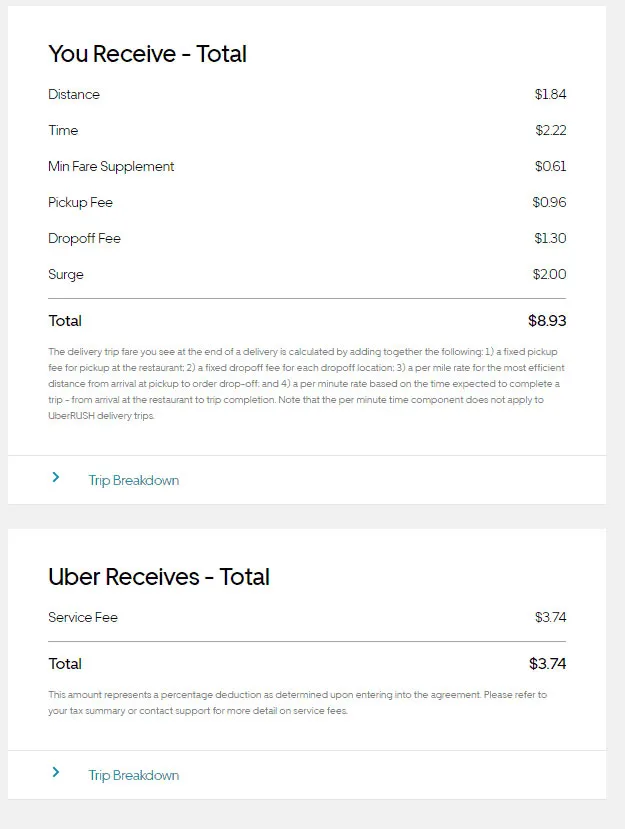

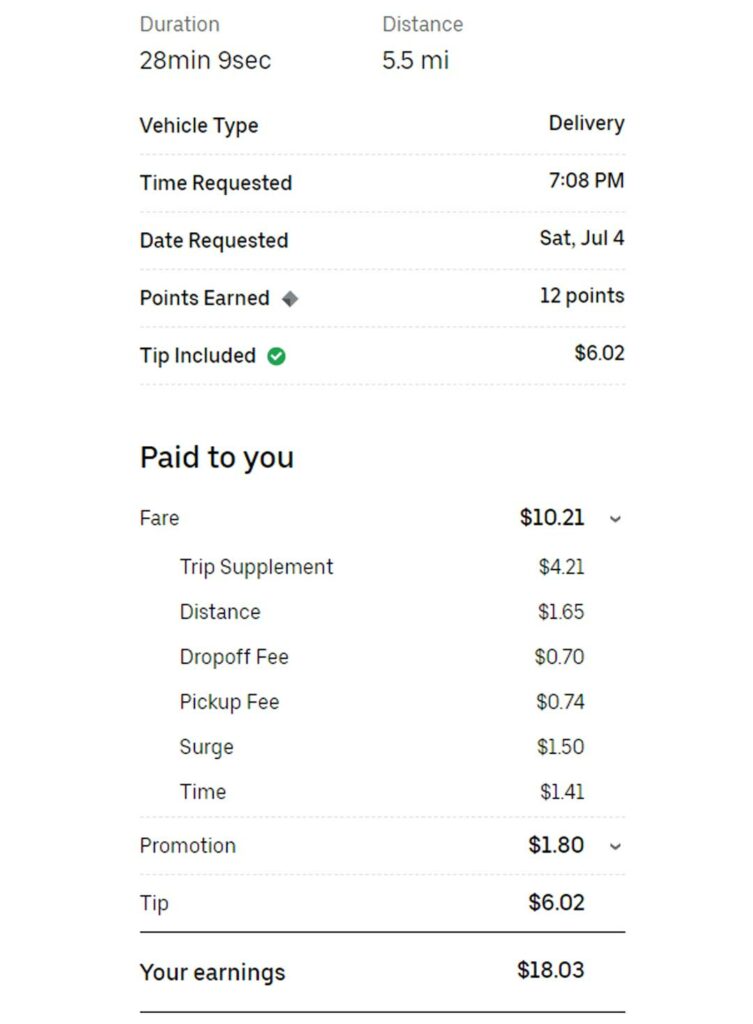

Regardless of how the customer pays the tip 100 of the tip goes to the Uber Eats driver. If you have more than 400 in income from your ridesharing work you need to pay self-employment taxes. Suppose the pickup fee is 150 the mileage fee is 050mile the time fee is 020minute the drop-off fee is.

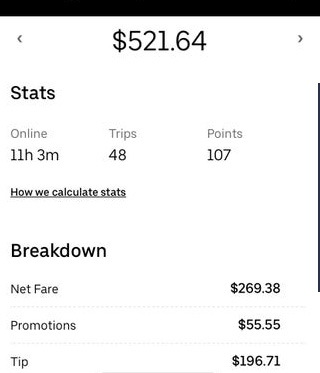

Use business income to figure out your self-employment tax. The exact percentage youll pay depends on your state and your tax bracket which is usually based on how much you earned over the calendar year. On average an Uber Eats driver could earn around 16 per hour.

A little less than 3 of the first 92. The IRS imposes modest interest penalties if you dont pay enough estimated tax. The keyword here is net earnings.

There will be a 15-dollar fee. 4 Income Tax for Uber 41 How Much Tax Will I Pay On My Uber Income. Please note some banks may take more time to process deposits.

Those who earn 400 or more from their ridesharing business may have to pay self-employment taxes. You must pay estimated taxes if you expect to owe at least 1000 in federal tax for the year from your ride-sharing business. During the 2021 tax year self-employment taxes will be levied at 15 percent.

Self-employment earnings are taxed at a rate of 35. In 2021 this would look like. Lets make it clear with an example.

I find that for every mile I get paid for I drive 12 mile to pick up. 11 Do Uber Drivers Have To Pay Tax. 10000 work miles x 056 mileage rate 5600 deduction.

Get your earnings within minutes when you cash out in the app. When does Uber Eats pay drivers. These are the rates you can expect to earn after deducting expenses including Ubers cut.

It also includes your income tax rate depending on your tax bracket. How Much Do Full Time Uber Drivers Pay In Taxes. Cause Ive seen it on the ATO website.

If you opted to receive a physical copy of your tax documents you should receive them in the mail after February 1 2022. 950 per hour if you drive your own car. Tax on 92 percent for SECA was 3 percent.

If your accounts for Uber Eats and Uber use a different email address your earnings from deliveries and rides will separately determine if you meet the earnings and trip criteria to receive a 1099-K 1099-NEC andor a 1099-MISC. Ad A virtual restaurant turns your existing kitchen into a test kitchen. You will receive one tax summary for all activity with Uber Eats and Uber.

Cash out anytime once per day. The Tax Summary provides a detailed breakdown of your annual earnings and business. Your federal tax rate can vary from 10 to 37 while your state rate can be anywhere from 0 to 1075.

2 Registering with the ATO 21 Getting an ABN for Uber 22 Getting Registered for GST for Uber. 9 per hour if youre paying for your car through car finance. Estimate your business income your taxable profits.

8 per hour if you drive a hired car. For the 2021 tax year the self-employment tax rate is 153 of the first 9235 of your net earnings from self-employment. Youll probably need to earn a profit of at least 5000 or 6000 from your business to owe this much tax.

Hi Jess I have read that People who work with the Visa subclass 417 Working Holiday Visa have to pay 15 taxes even if earn less than 18200 but the margin goes up to 34000 or something with the 15. All you need is the following information. If you do not qualify to receive a 1099 this year youll still receive a Tax Summary on your Driver Dashboard and your Driver app.

Approximately 5652 came from 35 percent of this amount. This means you can deduct business expenses to reduce the amount of tax youll owe. Your average number of rides per hour.

What the tax impact calculator is going to do is follow these six steps. Your federal income tax return includes this amount. I found that as an Uber driver I dont make enough to pay taxes.

Uber only pays 60 cents a mile. Yes you need to pay tax if you drive for Lyft Uber or similar companies like Uber Eats and other ride-share companies. Standard IRS Mileage Deduction.

Besides you dont get paid for the Miles you drive to pick someone up. Your federal and state income taxes. Some have found they are making only about minimum wage while others make 15 16 or 17 per hour on a good night.

Australians is that true. Two-day cashout previously called Flex Pay Get your earnings within two business days when you cash out in the app before 1400 Monday to Friday. Add other income you received wages investments etc to.

As an Uber Eats driver your services are divided into two. The main exception is that you dont have to pay income taxes if your total annual income is less than the standard deduction which is 12550 if youre a single-filer for 2021 taxes what you file in early 2022 and 25100 for married couples filing. Uber Eats earnings are either hourly or weekly depending on your preference.

This is the easiest method and can result in a higher deduction. 12 Do Uber Drivers Have to Pay GST. It can be deducted from the employers payroll taxes which are basically employer contributions.

Payout pickup fee mileage fee time fee drop-off fee Ubers fee tips. Cash out anytime up to 5 times per day. The IRS allows you to write off 56 cents per mile.

Expect to pay at least a 25 tax rate. If you want to get extra fancy you can use advanced filters which will allow you to input. How much do Uber drivers pay In taxes.

Recently Ubers UK head of public policy Andrew Byrne revealed three typical hourly rates. This applies to earnings on both Uber rides and Uber Eats. As such some can make significantly more than this while others make much less.

Using our Uber driver tax calculator is easy. How Much Tax Do You Pay As An Uber Eats Driver. The average number of hours you drive per week.

Should You Tip Uber Eats Drivers Via App Or Cash 2021 Uponarriving

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972766/IMG_4316.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Highest And Lowest Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver

How Much Does Uber Eats Cost And Learn How To Save On Orders Ridesharing Driver

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/15972748/Screen_Shot_2019_03_19_at_1.52.15_PM.png)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

Uber Eats Orders Apps On Google Play

Doordash Vs Grubhub Vs Uber Eats Vs Postmates Which Pays Fangwallet

Uber Eats Makes Delivery To International Space Station Fox Business

/cdn.vox-cdn.com/uploads/chorus_asset/file/13300243/919042992.jpg.jpg)

Uber Eats Rolls Out Confusing New Fees Here S What They Mean The Verge

18 Dollar Difference Between Restaurant Receipt And The Uber Eats Receipt R Mildlyinfuriating

This New Fee System Is Bullshit 89 Markup R Ubereats

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

How Much Does Uber Eats Pay Six Factors Impacting Pay Rate

/images/2019/09/23/ultimate_guide_to_earning_money_as_a_delivery-partner_with_uber_eats.jpg)

Ultimate Guide To Earning Money As A Delivery Person With Uber Eats 2022 Financebuzz

How To Become An Uber Eats Driver Thestreet

Why Does My Uber Eats 1099 Or Annual Tax Summary Say I Made More Than I Did Entrecourier

How Much Does Uber Eats Pay Six Factors Impacting Pay Rate

Ubereats Couriers To Strike In London Over Pay Dispute The Independent The Independent

Highest And Lowest Uber Eats Driver Pay From 880 Week To 1 50 Orders Ridesharing Driver